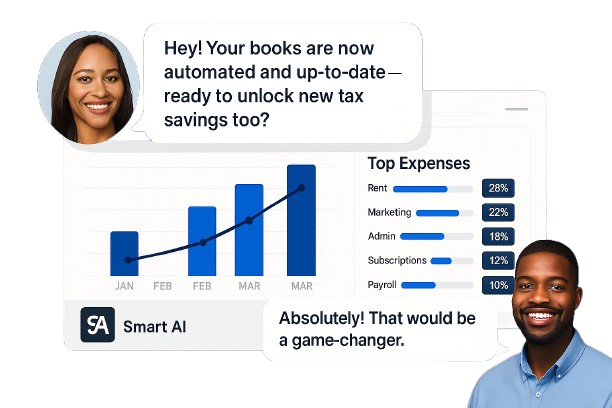

Clear, proactive accounting for business owners who want clarity

Smart AI Accounting is a digital-first UK accounting firm, based in Salisbury, supporting limited company directors and small businesses across the UK.

We help you understand your numbers, stay ahead of tax, and make confident decisions — without surprises, or last-minute stress.

We help you understand your numbers, stay ahead of tax, and make confident decisions — using modern systems backed by professional judgement.

Your records kept accurate, organised, and compliant — without chasing receipts or worrying about deadlines.

Expert Tax Advice

Make informed decisions with our advisory services.

Real-time bookkeeping powered by Xero and Dext

Automatic transaction syncing and categorisation

No spreadsheets or paper — fully cloud-based

Monthly reports and expert review

Keeps your business organised and audit-ready

Self Assessment, Corporation Tax, and VAT submissions

Timely and accurate HMRC filings

Uses real-time bookkeeping data

No last-minute stress or missed deadlines

Full compliance support all year round

Monthly reports on profit, cash flow, and trends

Easy-to-read, jargon-free insights

Helps with funding, planning, and growth

Informed decision-making backed by real data

Stay in control of your finances

Strategic financial planning without full-time CFO costs

Budgeting, forecasting, and growth support

Monthly check-ins and financial dashboards

Advice on funding, scaling, and exits

A clear financial roadmap for smart business decisions

How it works

Getting started with Smart AI Accounting is simple. Whether you're a freelancer, sole trader or limited company, we make the process smooth, stress-free, and fully digital — so you can focus on running your business, not your books.

Step 1: A simple conversation

A short, no-pressure call to understand your business and what support would genuinely help.

Step 2: We set things up properly

We connect your systems, clean up the foundations, and make sure everything is working as it should.

Each month, you get clear updates, practical guidance, and peace of mind that things are under control.

Step 3: Ongoing clarity and support

“Smart AI Accounting made my bookkeeping effortless. I just snap receipts, and everything is taken care of. The reports help me feel in control again.”

As a new business owner, I had no clue about taxes. Their virtual CFO service helped me set targets, forecast cash flow, and stop panicking.”

Ryan M., Tech Startup Founder

★★★★★

“Genuinely the most stress-free experience I’ve ever had with accounting.”

Louise D., Online Retailer

What You Can Expect

Jasmine O., Freelance Designer

★★★★★

★★★★★

Your records stay organised and compliant, without last-minute panics.

We explain what’s happening in your business — profits, cash flow, and tax — in a way that actually makes sense.

📊

When decisions matter, you have someone to talk things through calmly and clearly.

🤝

What You Can Expect

📘

Stress-Free Bookkeeping

Clear Monthly Insights

Guidance You Can Rely On

Ready to feel more in control of your business finances?

If you’re tired of unclear numbers, reactive accounting, or last-minute surprises, the next step is a simple conversation.

Technology that supports clear, reliable accounting

We use HMRC-compatible, trusted systems to keep everything accurate, secure, and in sync — so you don’t have to think about the tech.

Frequently asked questions

Do I need to use Xero or QuickBooks to work with you?

No — we’ll help you choose the right software for your business. If you're already using Xero, QuickBooks, or FreeAgent, we can connect to it. If not, we’ll guide you through setup during onboarding.

Are your services HMRC-compliant?

Yes — all our bookkeeping and tax services are aligned with UK tax rules and Making Tax Digital (MTD) requirements. We also use secure, HMRC-recognised software.

Who is Smart AI Accounting for?

We specialise in supporting UK-based freelancers, agency workers, consultants, and small limited companies. Whether you're a sole trader or growing team, we simplify your finances so you can focus on your work.

How do I send you receipts and invoices?

It’s all digital. Just take a photo or forward receipts by email. We use tools like Hubdoc to extract the data automatically — no paperwork or spreadsheets needed.

What’s included in the free consultation?

You’ll speak directly with an accountant who will review your needs, explain how our services work, and recommend the best plan for you. There’s no obligation to sign up.

Can you help with both personal and business taxes?

Yes. We support directors and sole traders with both company accounts and Self Assessment tax returns. If you're not sure what you need to file, we’ll walk you through it.

Smart Financial Tips for Small Businesses

We share practical advice on bookkeeping, taxes, and growth strategy to help UK small business owners stay financially fit — even without a finance degree.

Write a short text about your service

Write a short text about your service

Branding & Message

Social Media

Smart AI Accounting Ltd.

Helping UK small businesses simplify their finances.

© 2025 Smart AI Accounting Ltd. All rights reserved.

Contact Info

📧 info@smartaiaccounting.com

📱 07882 527 345

📍 Amesbury, Salisbury, United Kingdom

🔗 LinkedIn | Facebook

Smart AI Accounting Ltd

Based in Salisbury | Supporting businesses across Amesbury, Wiltshire & the UK